310 Receivables Deloitte Accounting Research Tool

Content

By portfolio segment, qualitative information about how those defaults are factored into determining the allowance for credit losses. ● Qualitative information, by portfolio segment, discussing how such defaults factored into the determination of the allowance for credit Accounting For Loans Receivable losses. Qualitative information, by portfolio segment, discussing how such modifications factored into the determination of the allowance for credit losses. Example LI 4-1 illustrates a loan transfer from held for sale to held for long-term investment/not held for sale.

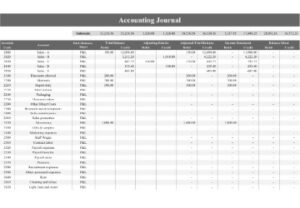

The BP type is a field on the BP master record that provides more definition within a BP group. A BP can only have one type at a time; however the BP type can be changed as needed by the MDM teams upon request. The number of roles created on the BP master record depends on the BP group. The following table shows for each BP group, what roles the UN Secretariat has decided to give to all BPs created in that group and what additional roles can be requested at the time of creation or later on an ‘as needed’ basis. It is the UNHQ responsibility to ensure that there are no parked documents in a period before the period is closed. Billing document generated through the SD interface by the Senior FI User with VF04 based on approved Sales Orders or Grants in Award status.

3.2. Notes Receivable

The manager does his analysis of your credentials and financials and approves the loan, with a repayment schedule in monthly installments based upon a reasonable interest rate. You walk out of the bank with the money having been deposited directly into your checking account. Set up an asset account called «Note Receivable – » or something similar. Start by creating a liability account to ensure accuracy when recording the loan.

If the current amount of AFDA is more than what is required for the period under review, the following entry will be created as parked document. De-select each amount except the one intended to apply the incoming payment to. For detailed steps on this process, refer to above steps P.1 through P.16 with the exception of step P.9 for the journal entry. Instead of credit to customer account or BP with posting key 15, it will be Posting Key 50 and credit to Unapplied Cash account . This process follows the incoming payment processing from Cash Management; Daily Reconciliation of Bank Transactions and Incoming Payment Processing – Cheque and Cash.

Loans and similar debts

Other receivable primarily includes amounts receivable for goods or services provided to other entities, amount receivable for operating lease arrangements, and loans/advances to staff, Inter fund balance. Loans and receivables are assessed at each reporting date to determine whether there is objective evidence of impairment. Evidence of impairment includes default or delinquency of the counterparty or permanent reduction in value of the asset. Impairment losses are recognized in surplus or deficit in the Statement of Financial Performance in the year they arise. Suppose you took a loan of $20,000 from the bank to buy a bike’s spare parts. The bank gave you $20,000, and now you have to pay them $20,000 in a given period of time, along with the bank fee and interest.

Say a total of $100,000 is there in the receivable, and 98% of the asset value is received as an advance. It is highly beneficial for businesses as it helps businesses to free up cash and use it to meet daily operation goals. Accounts Receivable, though it stands as a liquid asset, still sometimes takes time to be converted to hard cash. It also helps businesses run properly by keeping the receivables as collateral or selling them.

Deloitte guidance on IFRSs for financial instruments

The effective interest rate is the rate that exactly discounts estimated future cash payments or receipts through the expected life of the financial instrument to the net carrying amount of the financial asset or liability. Financial assets that are not carried at fair value though profit and loss are subject to an impairment test. If expected life cannot be determined reliably, then the contractual life is used. The primary benefit of accounts receivable financing is that you collect most of the money owed in a short time. Because you sell the invoices, rather than borrowing against them, you do not pay any interest and you do not have to list an additional liability on your balance sheet. Factoring companies normally share their credit analysis of customers with you, so you gain information that will be useful when doing business with these customers in the future.

Please contact your local Novogradac & Company LLP office to discuss any questions you have regarding the potential impairment of your loans. Finance Strategists is a leading financial literacy non-profit organization priding itself on providing accurate and reliable financial information to millions of readers each year. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

Businesses

Click herefollow step-by-step examples, including footnote disclosures, for GAAP treatment of factoring agreements, lockboxes and acceleration clauses. If the agreement requires that the outstanding balance be reduced to zero at least once each year , all of the borrowing shall be classified as current (see ASC Subtopic ). Examples of receivables that would be ineligible are receivables that are more than 90 days old and related-party receivables. The difference between the issue price of the bonds with bond warrants and the actual value of the bonds is recorded as deferred income for the bonds. If the financial guarantee contract was issued in a stand-alone arm’s length transaction to an unrelated party, its fair value at inception is likely to equal the consideration received, unless there is evidence to the contrary.

If there were no uncollectible receivables, Ashton will eliminate the recourse liability amount and decrease the loss. Savoy’s net income will be the finance fee of $16,000 with no reductions in revenue due to uncollectible accounts, since these are being guaranteed and assumed by Ashton. In this case, Ashton guarantees payment to Savoy for any uncollectible receivables (re- course obligation). Under IFRS, the guarantee https://quick-bookkeeping.net/invoice-templates-for-word-and-excel/ means that the risks and rewards have not been transferred to the factor, and the accounting treatment would be as a secured borrowing as illustrated above in Cromwell—Note Payable. Under ASPE, if all three conditions for treatment as a sale as described previously are met, the transaction can be treated as a sale. The accounting treatment will be the same for IFRS and ASPE since both sets of con- ditions have been met.