What Is the Difference Between Unburdened & Burdened Labor Rates?

Content

Today, we’re going to show you how to calculate labor burden and what costs you should include in your labor burden rate. The burden rate is the allocation rate at which indirect costs are applied to the direct costs of either labor or inventory. You should add burden to the direct cost of either labor or inventory in order to present the total absorbed cost of these items. The two situations in which the burden rate is used are noted below. Those burdens that are mandatory are payroll taxes , federal and state unemployment insurance and, if state requires it, also workers’ compensation insurance, liability insurance, and state disability insurance. Your state or local government may also require a local payroll tax and job-training tax.

This is calculated by multiplying the total square footage of the project by the labor rate per square foot. This involves estimating the cost of labor and materials needed to complete the job within a certain area and then multiplying that cost by the total square footage of the entire project. This method is preferred by contractors who want to use historical data to quickly arrive at a rough estimate during the early stages of project planning. There isn’t a right or wrong way to do this, it really doesn’t matter. What matters is that you’re consistent; whatever assumptions you make when calculating your markup need to be considered when estimating your job costs.

What A Construction Worker On Your Payroll Really Costs

Extrapolate this process for each worker on each task, and an accurate labor cost can be determined for the entire job. These would be the hours that aren’t included when you estimate a project. There might be weekly company meetings, or maybe you know they’ll spend the equivalent of two full days a year working in the shop or cleaning out company vehicles. Maybe you know they spend an average of 15 minutes a day standing in line at a supplier.

Changing the benefits you offer employees is often a major driver for changes in the labor burden rate. If you are a construction business that doesn’t have a good understanding of your true labor burden costs you are risking underestimating jobs and this will eat into your profits. For example, will you keep all labor-related costs in your overhead? So that addresses why and when to consider your indirect costs and calculate your burdened labor rate – now let’s address how. Labor burden cost is important to compute and understand because it includes a variety of significant costs that are often viewed as company overhead, but are in fact, costs related to employment.

You’re our first priority.Every time.

It will be up to the user reviewing time to split entries into overtime or double time upon approval. If I hadn’t came across your website 6 years ago I would have scrapped the idea of running my own construction business entirely. I knew that you were onto exactly what I needed to hear when I first started what is fully burdened labor rate reading your website. I so look forward to your news letter every Wednesday it has so much depth in terms of useful content for your average good clean contractors. It really has made a big difference in the way I see things, I can now price my jobs fairly and have a clear conscience at the end of the day.

What is the burdened Labour rate?

The burden rate refers to the total cost to a company for hiring and maintaining an employee beyond their direct compensation in wages. Burden rates will include items such as training, fringe benefits, sick leave, and pension contributions, among several others.

Vacation pay, health insurance, and any other benefits or expenses related to employment are included. Its often convenient to calculate a labor burden rate to use across your company as it makes estimating easier and ensures you are always covering your complete labor burden costs. A labor burden rate is simply a percentage markup you apply to the employee pay rate to determine their total cost including labor burden. The burden rate takes into account all of the auxiliary, indirect, and incidental costs of hiring and retaining a worker that are often not readily apparent. Because total labor costs may be as much as 50% higher than base payroll costs alone, it is necessary to calculate the burden rate accurately to get a better picture of profitability and efficiency per worker.

How Often You Need to Recalculate Your Labor Burden Rate

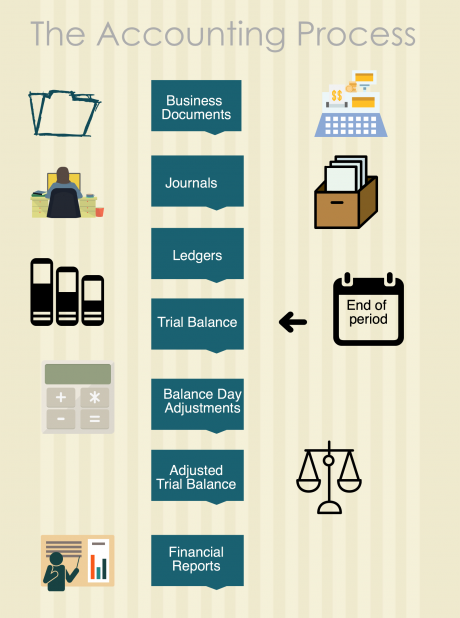

The association of burden with inventory is required by the accounting standards , so that the full cost of inventory is reported in a company’s balance sheet. This information is of less use for internal decision-making purposes, where managers typically use direct costs instead. Further, any food or beverage offerings, wellness activities, training costs, lodging for business trips, and required uniforms may be added if the services are provided by the company. Are you sure all of your dollars are accounted for at all times? This means that there are employees enrolled in benefits now who are on unpaid leave or who have terminated employment. Have those persons been removed from active employee coverage and offered COBRA?

- But being aware of exactly how much labor is going to cost you in various parts of the globe can also make or break your company — for example, taxes, benefits, and wages are vastly different in Tokyo vs France.

- The fully-burdened labor cost is the full hourly cost to employ a worker for the hours she actually works, which includes wages and the “burden” of the additional costs.

- Payroll taxes also include labor cost taxes, Social Security taxes, Medicare taxes, and state and federal unemployment taxes.

- Effectively allocating indirect costs will change how accurately your jobs are reported.

- Using your labor burden rate when estimating projects will help correctly identify exactly how much a project will actually cost.